Asset Turnover Ratio Formula, Analysis & Example

The higher the asset turnover ratio, the better the company is performing, since higher ratios imply that the company is generating more revenue per dollar of assets. Asset turnover ratio is the ratio of a company’s net sales to its average total assets. when are credits negative in accounting chron com It is an asset-utilization ratio which tells us how efficiently the company is using its assets to generate revenue. Asset turnover is not strictly a profitability ratio; it only measures how effectively a company uses its assets to generate sales.

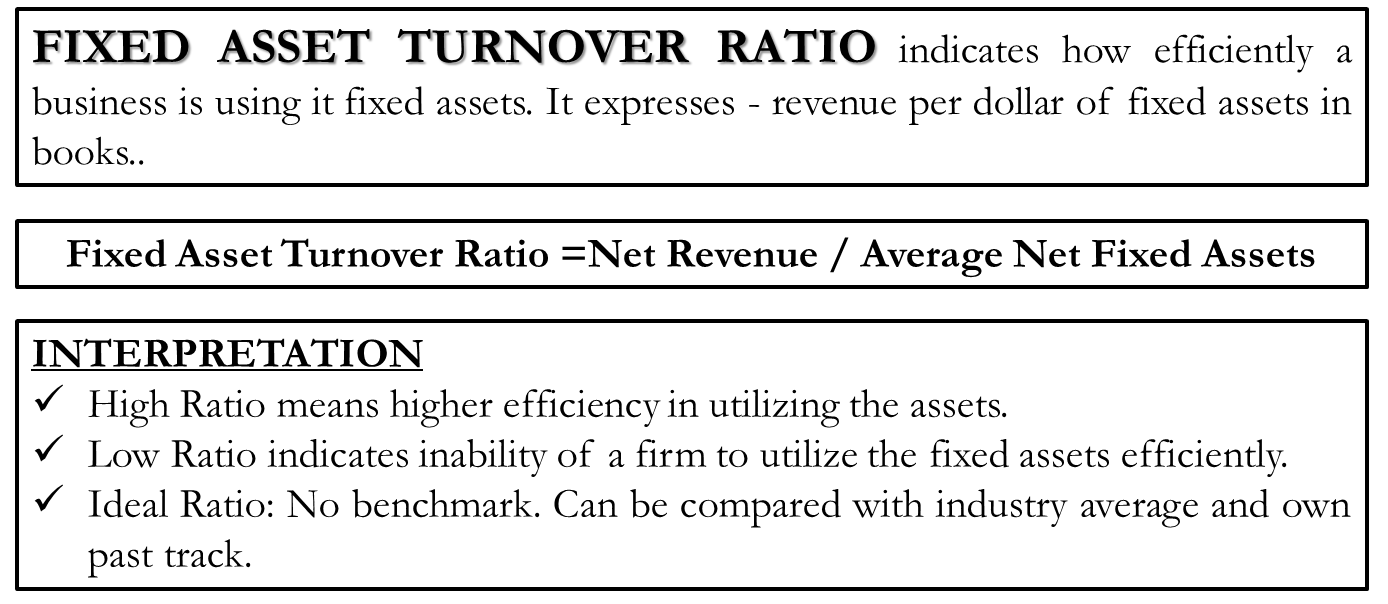

What Is the Main Downside to the Fixed Asset Turnover Ratio?

When comparing the asset turnover ratio between companies, ensure the net sales calculations are being pulled from the same period. A high asset turnover ratio indicates a company that is exceptionally effective at extracting a high level of revenue from a relatively low number of assets. As with other business metrics, the asset turnover ratio is most effective when used to compare different companies in the same industry.

Everything You Need To Master Financial Modeling

In much simpler terms, by finding your asset turnover, you can figure out how many dollars of sales you’re generating for every dollar in the value of assets you have. This accounting principle is a peek into the efficiency of your business—whether or not you’re using the assets you have, both fixed and current, to generate sales. The asset turnover ratio formula is net sales divided by average total sales. It is an accounting formula that allows a business to see how efficiently they’re using their assets to create sales. A good asset turnover ratio will differ from business to business, but you’ll typically want an asset turnover ratio greater than one.

Most WantedFinancial Terms

It’s used to evaluate how well a company is doing at using its assets to generate revenue. Average total assets are usually calculated by adding the beginning and ending total asset balances together and dividing by two. A more in-depth, weighted average calculation can be used, but it is not necessary. The asset turnover ratio is used to evaluate how efficiently a company is using its assets to drive sales. It can be used to compare how a company is performing compared to its competitors, the rest of the industry, or its past performance.

Asset Turnover: Formula, Calculation, and Interpretation

Hence, it’s important to benchmark the ratio against industry averages and competitors. The answer is that a high ratio implies that a company is in good standing. It’s generating value with its assets, which can signal that it may be a solid investment. • Current assets are things that the company predicts will be converted into cash within the next year, such as inventory or accounts receivable that will be liquidated. This means that for every dollar in assets, Sally only generates 33 cents.

- So, if you have a look at the figure above, you will visually understand how efficient Wal-Mart asset utilization is.

- For instance, if the total turnover of a company is 1.0x, that would mean the company’s net sales are equivalent to the average total assets in the period.

- The higher the number the better would be the asset efficiency of the organization.

- On the flip side, a turnover ratio far exceeding the industry norm could be an indication that the company should be spending more and might be falling behind in terms of development.

- Companies with strong ratios may review all aspects that generate solid profits or healthy cash flow.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Conversely, a high asset turnover ratio may be less significant for businesses with high-profit margins, as they make substantial profits on each sale. Companies can work on improving their asset turnover ratio by increasing sales, decreasing manufacturing costs, and improving their inventory management. Other ways they can improve include adding new products and services that don’t require the use of assets, and selling any unsold inventory still on hand. For instance, a ratio of 1 means that the net sales of a company equals the average total assets for the year.

A company’s asset turnover ratio will be smaller than its fixed asset turnover ratio because the denominator in the equation is larger while the numerator stays the same. It also makes conceptual sense that there is a wider gap between the amount of sales and total assets compared to the amount of sales and a subset of assets. While a ratio greater than 1 is generally favorable, indicating effective use of assets, interpretation should always be made in the context of the industry, the company’s profit margin, and its business model. The total asset turnover ratio should be used in combination with other financial ratios for a comprehensive analysis.

All of our content is based on objective analysis, and the opinions are our own. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.